mrplunkey

New member

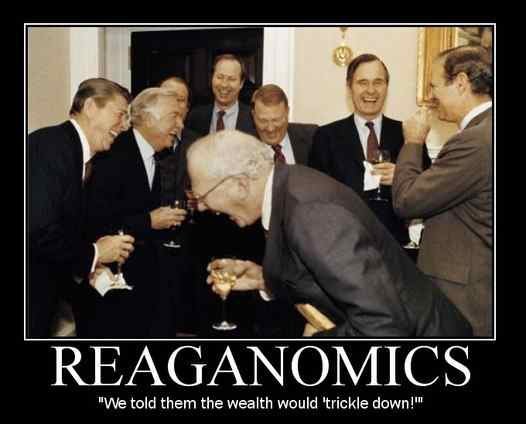

Also keep in mind that those numbers dont include state taxes. When you factor in local income, sales, and property taxes, the middle class gets boned even futher - state taxes are much more regressive than federal taxes.

That's not true at all. Property taxes go up with property value. If a top earner doesn't want a high-end piece of real estate, there's no reason they should pay higher taxes.

And the same can be said for sales taxes.

Plus, state taxes are graduated and in loony states like CA, include additional penalties for $1M+ earners.

Please Scroll Down to See Forums Below

Please Scroll Down to See Forums Below