ProfessorSwole

New member

Finally, Subprime Foreclosure Rates by Race

Many people can't believe that minorities could account for so much of mortgage meltdown, but there are now over 100 million minorities in the U.S. Furthermore, their mortgages tended to be relatively larger than one might expect because they tend to live in fairly expensive urban areas rather than in dirt cheap rural areas.

A variety of evidence has long pointed toward minorities accounting for a disproportionate fraction of the defaulted subprime mortgage losses that set off the economic crash. This would hardly be surprising since the government pushed hard to increase lending to minorities of marginal creditworthiness in the name of increasing minority homeownership. The Clinton Administration teamed up with leftist groups like Obama’s colleagues at ACORN to push for more lending to minorities. The Bush Administration stepped up the pace, denouncing down payments as barriers holding minorities back from the American Dream, in part to convert the growing Hispanic population into homeowning Republicans.

But, like the guns of Singapore in 1941, the government’s statistics-collecting apparatus is designed only to make sure that minorities are getting enough loans, not to count how often they default on their mortgages. So, we’ve been lacking direct data on foreclosure rates in the current Housing Bubble.

Back in October, my reader Tino calculated from the federal Home Mortgage Disclosure Act database that minorities got half the subprime cash (for home purchases and refinancings) handed out in the big years of 2004-2007. Mortgage dollars (prime and subprime) for home purchases leant to Hispanics went up 691% from 1999 to 2006 and 397% for blacks (but only 218% for Asians and about 100% for whites). In other words, mortgage lending to Hispanics almost octupled from 1999 to the peak of the Housing Bubble in 2006. Thus, a sizable majority of defaulted dollars lost are in just four heavily Hispanic states: California, Arizona, Nevada, and Florida (what Wall Street called the “Sand States”).

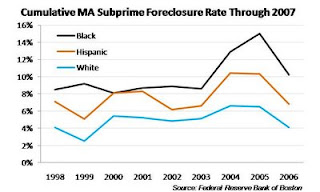

But, what about foreclosure rates by race?

Finally, Subprime Foreclosure Rates by Race | National Policy Institute

Many people can't believe that minorities could account for so much of mortgage meltdown, but there are now over 100 million minorities in the U.S. Furthermore, their mortgages tended to be relatively larger than one might expect because they tend to live in fairly expensive urban areas rather than in dirt cheap rural areas.

A variety of evidence has long pointed toward minorities accounting for a disproportionate fraction of the defaulted subprime mortgage losses that set off the economic crash. This would hardly be surprising since the government pushed hard to increase lending to minorities of marginal creditworthiness in the name of increasing minority homeownership. The Clinton Administration teamed up with leftist groups like Obama’s colleagues at ACORN to push for more lending to minorities. The Bush Administration stepped up the pace, denouncing down payments as barriers holding minorities back from the American Dream, in part to convert the growing Hispanic population into homeowning Republicans.

But, like the guns of Singapore in 1941, the government’s statistics-collecting apparatus is designed only to make sure that minorities are getting enough loans, not to count how often they default on their mortgages. So, we’ve been lacking direct data on foreclosure rates in the current Housing Bubble.

Back in October, my reader Tino calculated from the federal Home Mortgage Disclosure Act database that minorities got half the subprime cash (for home purchases and refinancings) handed out in the big years of 2004-2007. Mortgage dollars (prime and subprime) for home purchases leant to Hispanics went up 691% from 1999 to 2006 and 397% for blacks (but only 218% for Asians and about 100% for whites). In other words, mortgage lending to Hispanics almost octupled from 1999 to the peak of the Housing Bubble in 2006. Thus, a sizable majority of defaulted dollars lost are in just four heavily Hispanic states: California, Arizona, Nevada, and Florida (what Wall Street called the “Sand States”).

But, what about foreclosure rates by race?

Finally, Subprime Foreclosure Rates by Race | National Policy Institute

Please Scroll Down to See Forums Below

Please Scroll Down to See Forums Below